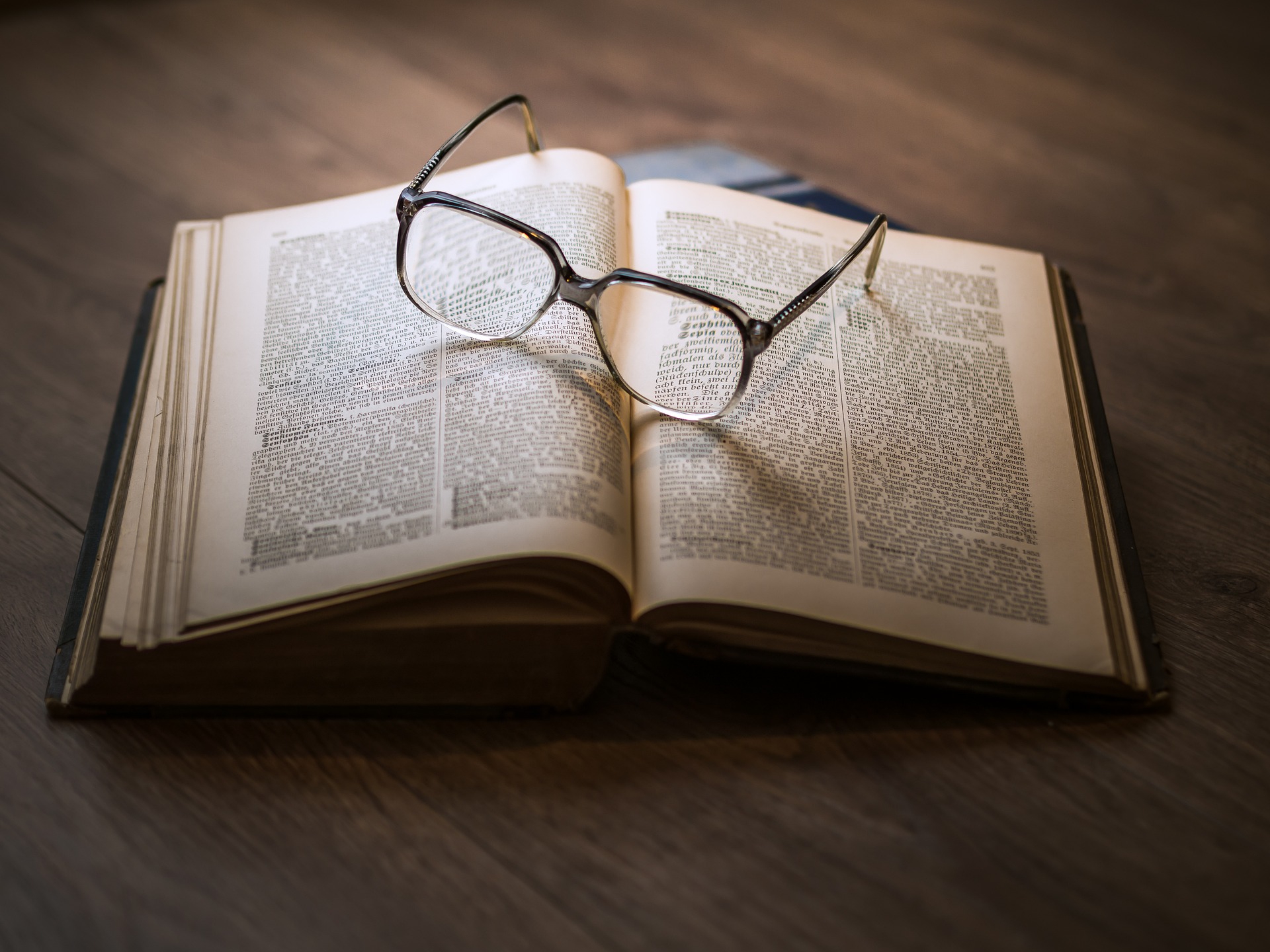

Different types of securities in Indian stock market

The Indian stock market offers a wide range of stocks and securities for investors to choose from. Understanding the different types of stocks and securities available in the market can help investors make informed decisions and create a well-diversified portfolio.

- Equity shares: Equity shares, also known as common stock or ordinary shares, represent ownership in a company. They give the holder the right to vote at shareholder meetings and the right to receive dividends. The value of equity shares is determined by the company’s performance and market conditions.

- Preferred shares: Preferred shares are a type of equity that gives the holder a fixed dividend, which is paid before dividends are paid to common shareholders. Preferred shareholders also have a higher claim on the company’s assets in the event of bankruptcy. However, they do not have the same voting rights as common shareholders.

- Debt securities: Debt securities, also known as fixed-income securities, are issued by companies, governments, and other organizations to borrow money. Examples of debt securities include bonds, debentures, and commercial papers. Investors who buy debt securities receive periodic interest payments and are repaid the principal amount when the security matures.

- Derivatives: Derivatives are financial instruments that derive their value from an underlying asset, such as a stock or commodity. Examples of derivatives include options, futures, and swaps. Derivatives can be used to hedge risk or speculate on the price movement of the underlying asset.

- Mutual funds: Mutual funds are investment vehicles that pool together the money of many investors and invest in a diverse portfolio of stocks, bonds, and other securities. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the fund’s investors. Mutual funds offer investors the benefits of diversification and professional management, but they also come with fees and expenses.

- Exchange-traded funds (ETFs): ETFs are similar to mutual funds in that they invest in a diverse portfolio of stocks and other securities. However, ETFs are traded on an exchange like individual stocks and can be bought and sold throughout the day. ETFs offer investors the benefits of diversification and low costs, but they also carry the risks associated with the underlying securities.

- Real estate investment trusts (REITs): REITs are companies that own and manage income-generating real estate properties, such as office buildings, shopping centers, and apartments. REITs are required to distribute a certain percentage of their profits to shareholders as dividends. Investing in REITs can provide investors with exposure to the real estate market and a source of regular income.

- Initial public offerings (IPOs): IPOs refer to the process of a company issuing and selling its shares to the public for the first time. Companies go public to raise capital for expansion or to pay off debt. Investors who participate in an IPO have the opportunity to buy shares in a company at the beginning of its public trading history. However, IPOs carry additional risks, as the company’s financial performance and future prospects are not yet known.

- Government securities: Government securities are debt instruments issued by the central or state governments to finance their operations. Examples of government securities include treasury bills, treasury bonds, and state development loans. Government securities are considered to be among the safest investments as they are backed by the government and have a low risk of default.

- Corporate bonds: Corporate bonds are debt securities issued by companies to raise capital. Investors who buy corporate bonds receive periodic interest payments and are repaid the principal amount when the bond matures. The creditworthiness of the issuing company and the prevailing interest rates determine the yield on corporate bonds.

- Money market instruments: Money market instruments are short-term debt securities with maturities of up to one year. Examples of money market instruments include treasury bills, commercial papers, certificates of deposit, and interbank call money. Money market instruments are considered to be low-risk investments as they are issued by creditworthy entities and have short maturities.

It is important for investors to understand the risks and rewards associated with each type of stock and security before making any investment decisions. Different types of securities may be suitable for different investment objectives and risk tolerances. It is also important for investors to diversify their portfolio by including a mix of different types of securities in Indian stock market to spread risk and potentially increase the chances of earning returns.

Investing in the stock market carries inherent risks, and the value of investments may fluctuate due to market conditions. It is important for investors to do their own research and consult with a financial advisor before making any investment decisions.

Different types of securities in Indian stock market

Also read : Fundamental analysis of shares

Also read : Technical analysis of shares